“Truth is the daughter of time, not of authority.” Sir Francis Bacon

Investing is full of truisms: flavor-of-the-day stocks come and go. Currencies fluctuate. Markets go up and down. Diversify! Platitudes are cheap. The rustling bush sensations that our DNA tells us to run in times of danger, compels us to overreact in investing. We sell high and buy low. We panic. But when markets are frothy, we don’t have to sell, especially if we don’t need the money. Warren Buffett isn’t thinking about dumping American Express when he drives to Mcdonald’s1Yes he’s different than us, and much older, but the point still holds. for breakfast. He’s more likely to be thinking about opportunities, figuratively rubbing his hands together when markets are in turmoil.

Nobody sells their house just because real estate prices drop 10% over a 3-month period. There’s too much friction in fees, taxes, the cost of searching for a new place, and sore backs. We sell our home when it no longer fits our needs, we relocate to another city, or to use the cash for a better purpose, among others. Those are real motives.

We’re in a golden age of investing, especially in the US. Public markets boast of quick execution, narrowing bid/ask spreads, and the ability to sell $1 million worth of a blue chip without moving the price. We (should) sell when an investment thesis deteriorates or when there are better opportunities elsewhere. The data support this. The temptation of moving around a lot in and out of trades doesn’t correlate with long-term success. Study after study shows that. Taxes eat into returns too.

There is some good news on how we collectively behave. Most designated “long-term” assets surprisingly stay still, with trades happening in only 8% of accounts, according to Vanguard, and only 1-2% of retirement assets are out on loan, even during economic upheaval2Those in single target-date funds traded even less, with 97% of account holders not changing allocation during the year.. Very few are day-trading their retirement funds. We have guardrails in place, we see our 65-year-old future selves with whatever future glasses we have on, and we tune out the noise. The structure with benevolent gates and rules helps protect us from our baser impulses. We all have blind spots, but we have spouses, partners, rules, and the goldilocks of diversification, to help protect us from ourselves.

We cast aside what doesn’t work and we’re left with learning, lots of reading and sitting, and little investment activity3This is our routine and philosophy at Diamond Lake Capital.. We can ask ourselves daily for one week, “Do I really want to do this based on facts, or based on feelings or momentum from a European fund’s pension liquidation?” As Munger says, “Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.” That is our focus.

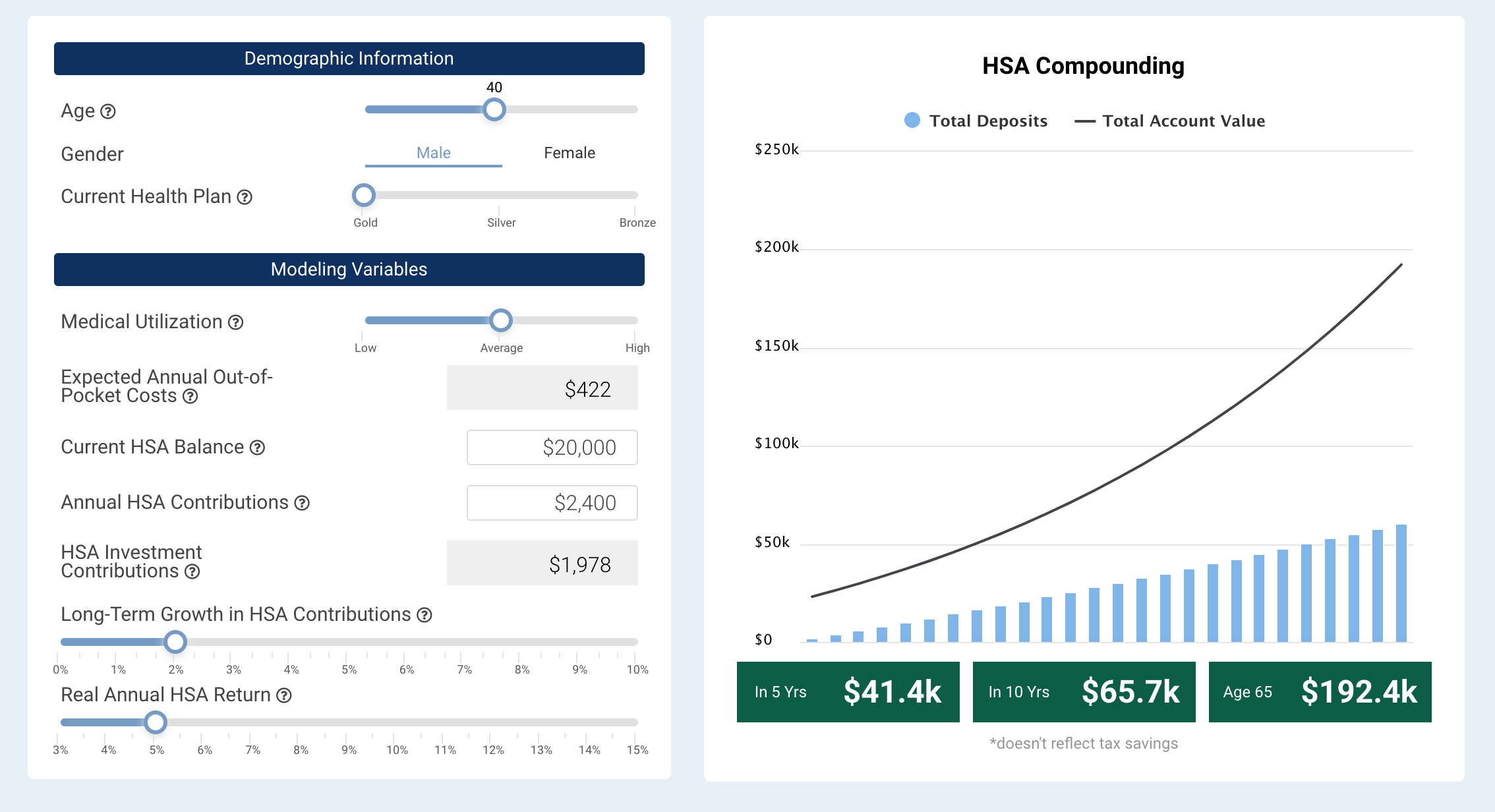

With that focus, we help in some of the forgotten corners of investment spaces. One is Health Savings Accounts (HSAs), where, still, less than 7% of account holders invest any of their balance. A few hundred dollars a month in an HSA, consistently invested, goes a long way to hedging our healthcare costs in retirement, with the beauty of boosted tax savings. Ask about our free assessment of your HSA.

Photo by Alexander Jawfox on Unsplash